Top Areas to Invest in Hyderabad in 2025: Land Appreciation & Rental Income Guide

Hyderabad continues to shine as one of India’s hottest real estate markets. With its booming IT sector, expanding infrastructure, and strong economic fundamentals, the city has become a magnet for investors looking for both capital appreciation and steady rental income. Whether you are a first-time buyer, an NRI investor, or a seasoned property owner, choosing the right location is critical for maximizing returns.

This blog highlights the top investment hotspots in Hyderabad, along with current land prices, growth potential, and rental yield trends.

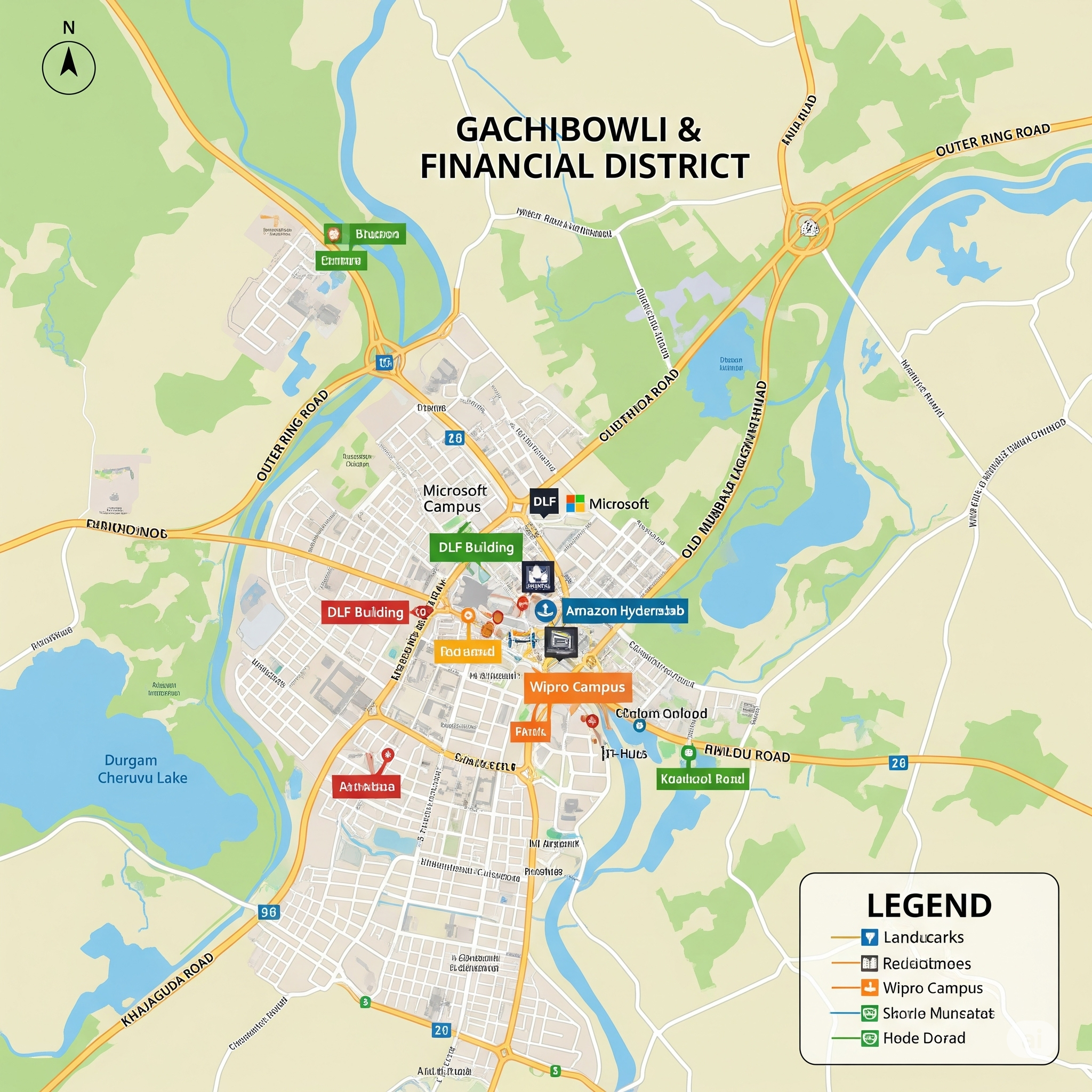

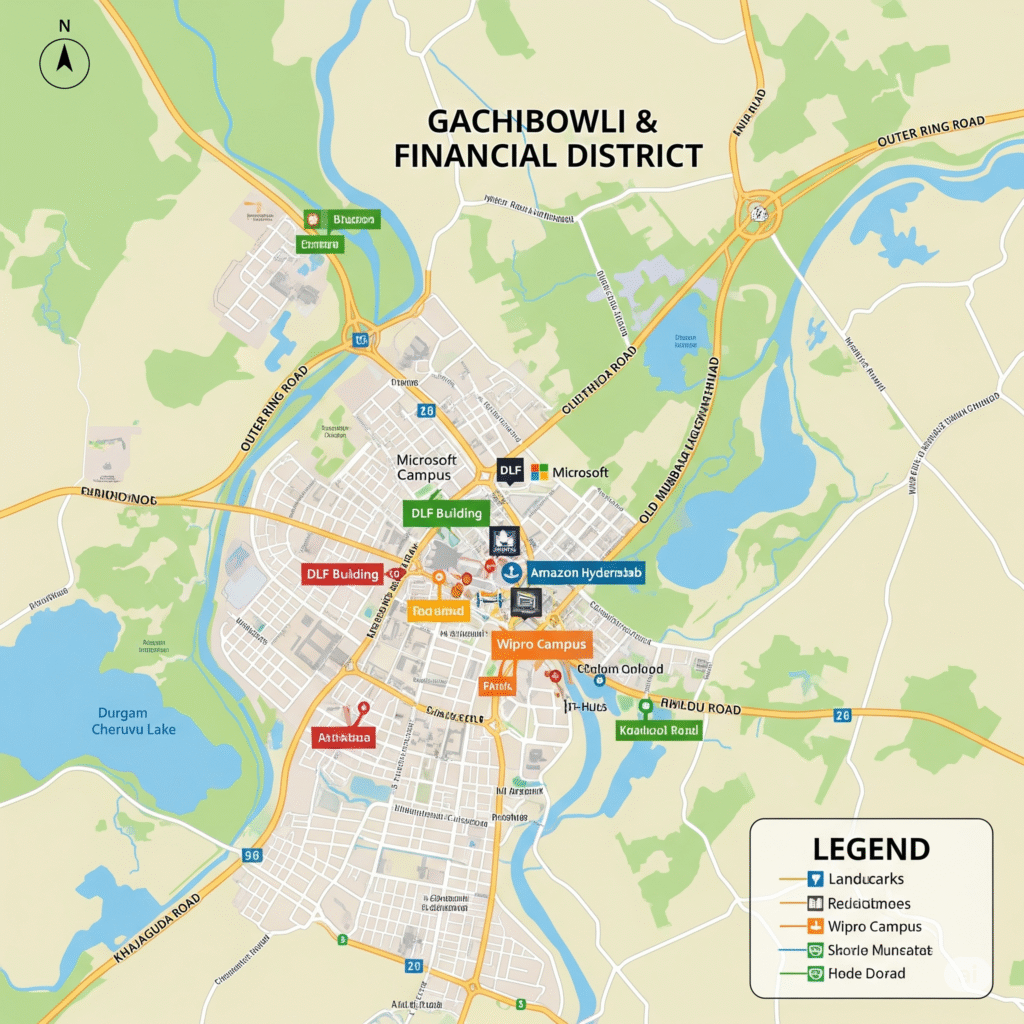

1. Gachibowli & Financial District – The IT Powerhouse

- Current Land Rate: ₹1,00,000–₹1,50,000 per sq. yard

- Rental Yield: 4%–6% (among the highest in Hyderabad)

Gachibowli and the Financial District are the beating heart of Hyderabad’s IT and BFSI sectors. With global companies like Microsoft, Amazon, and Google expanding their offices here, the demand for premium housing and office space has skyrocketed.

Why Invest?

- Strong rental market from IT professionals and expatriates.

- Rapid appreciation due to limited land availability.

- Excellent infrastructure: Outer Ring Road (ORR), upcoming metro expansion, international schools, and hospitals.

Ideal for: Investors seeking high rental income and long-term appreciation in luxury apartments or premium commercial spaces.

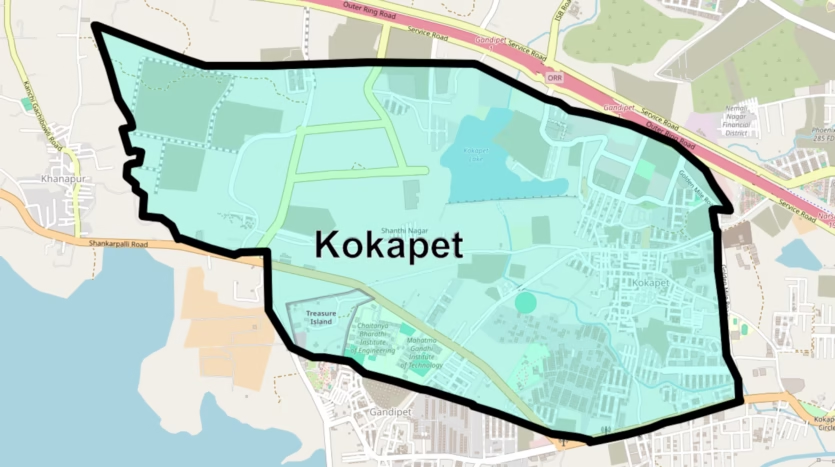

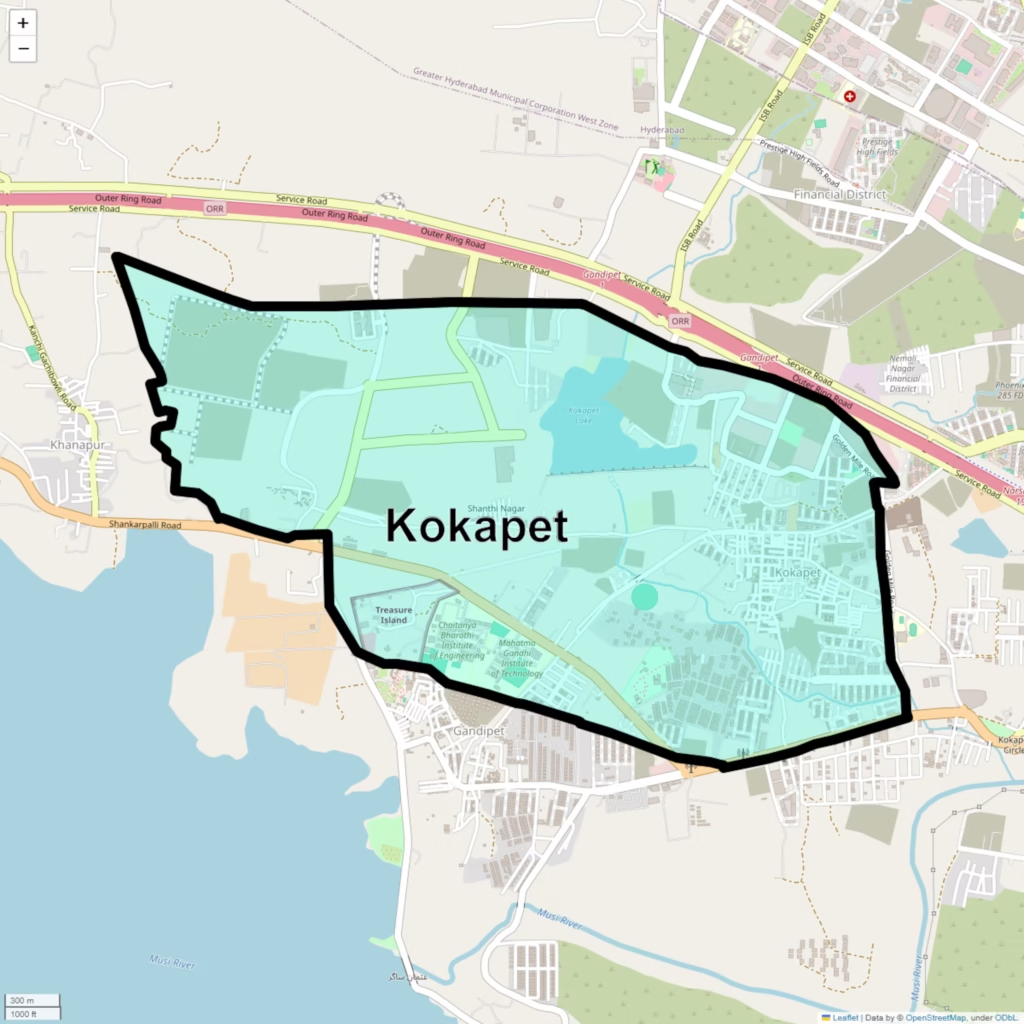

2. Kokapet & Narsingi – Hyderabad’s Next Luxury Hub

- Current Land Rate: ₹50,000–₹80,000 per sq. yard

- Rental Yield: 3%–5%

Located close to the Financial District, Kokapet is emerging as a premium residential hub, driven by government initiatives like the “Neopolis” SEZ and HMDA land auctions at record prices. Narsingi, just next door, is benefiting from the same growth wave with mid-premium apartment projects.

Why Invest?

- Proximity to IT hubs and Outer Ring Road ensures easy connectivity.

- High-end residential projects are attracting NRIs and corporate executives.

- Steady land price growth with potential for 15%–20% annual appreciation in some pockets.

Ideal for: Long-term investors looking for luxury residential plots or apartments in a high-growth corridor.

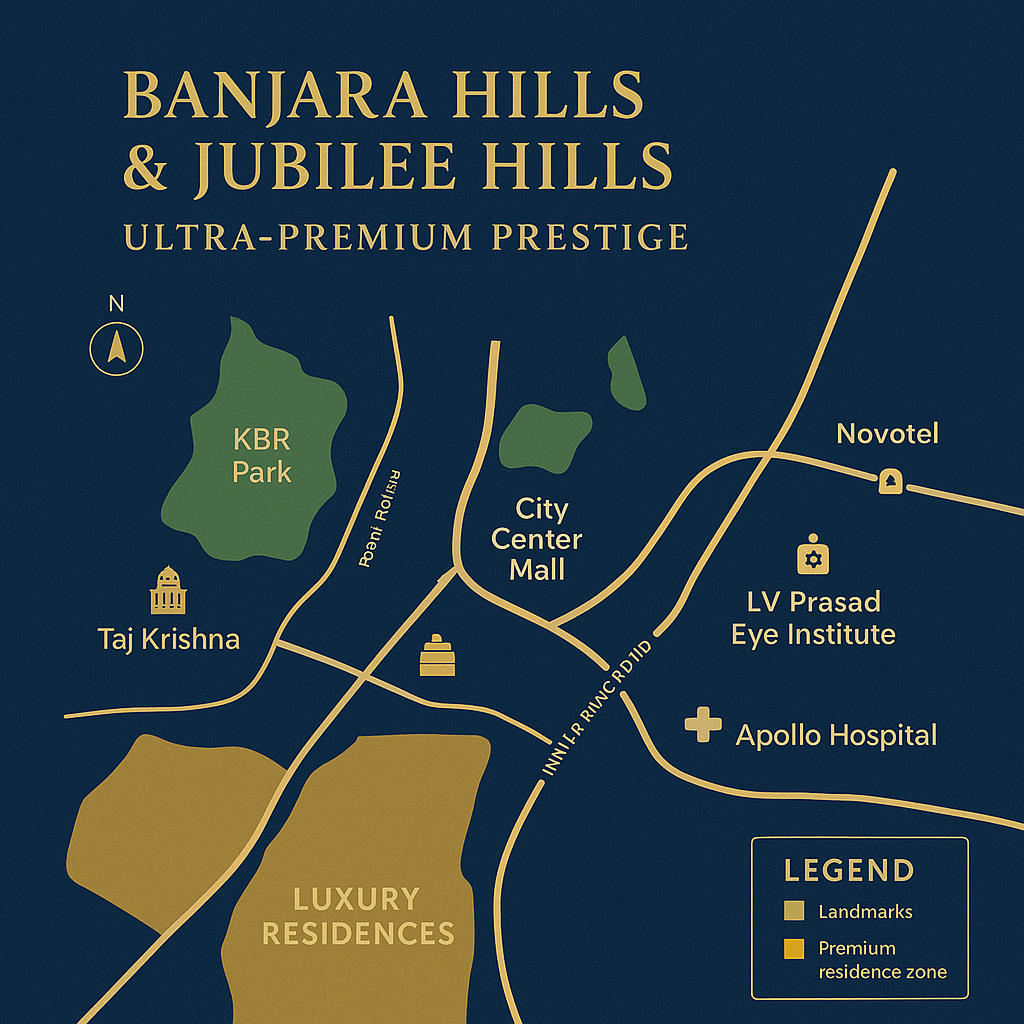

3. Banjara Hills & Jubilee Hills – Ultra-Premium Prestige

- Current Land Rate: ₹1,50,000–₹2,50,000 per sq. yard

- Rental Yield: 2%–3%

Banjara Hills and Jubilee Hills remain Hyderabad’s most prestigious addresses, known for upscale villas, celebrity residences, and high-profile commercial activity. Though entry costs are steep, these areas offer stable appreciation and unmatched social infrastructure.

Why Invest?

- Limited supply makes land values resilient even during market slowdowns.

- Top-class amenities, healthcare, and luxury retail.

- Long-term capital appreciation averaging 8%–12% annually.

Ideal for: HNI and NRI investors who prioritize prestige, security, and stable long-term growth over immediate rental yield.

4. Miyapur, Bachupally & Kondapur – Affordable Growth Corridors

- Current Land Rate: ₹30,000–₹50,000 per sq. yard (Miyapur/Bachupally)

- Apartment Rates in Kondapur: ₹6,000–₹9,000 per sq. ft.

- Rental Yield: 3%–4%

These western Hyderabad suburbs are rapidly urbanizing with good metro connectivity and affordable housing options, making them attractive to mid-income professionals.

Why Invest?

- Popular among first-time buyers and IT employees.

- Upcoming infrastructure upgrades boost long-term appreciation.

- Balanced mix of end-user demand and investor interest.

Ideal for: Budget investors looking for steady rental demand and gradual price growth.

5. Uppal – The New Eastern Growth Engine

- Current Land Rate: ₹40,000–₹65,000 per sq. yard (varies by locality)

- Rental Yield: 3%–4%

Uppal, located in East Hyderabad, is transforming into a major residential and commercial hub. With the Uppal Metro Station, IT parks like NSL Arena, and proximity to Nagole and LB Nagar, this area is attracting both homebuyers and investors.

Why Invest?

- Excellent connectivity to key employment hubs via metro and Inner Ring Road.

- Infrastructure upgrades and new gated community projects driving appreciation.

- Balanced market – affordable for mid-income buyers with good rental potential.

Ideal for: Investors looking for well-connected, affordable plots and apartments with steady appreciation over the next 5–7 years.

. Adibatla & Shadnagar – Emerging Investment Hotspots

- Current Land Rate:

- Adibatla: ₹25,000–₹40,000 per sq. yard

- Shadnagar: ₹10,000–₹25,000 per sq. yard

- Rental Yield: Low now, but strong future potential

Adibatla is home to the TATA Aerospace SEZ and other major industrial developments, while Shadnagar enjoys excellent connectivity via NH-44 and proximity to Hyderabad airport.

Why Invest?

- Low entry cost compared to western Hyderabad.

- High appreciation potential once industries and SEZ projects mature.

- Government focus on aerospace and defense clusters in this region.

Ideal for: Investors with a long-term horizon (5–10 years) seeking high ROI on plots or gated community ventures.

7. Shamshabad – Airport Growth Zone

- Current Land Rate: ₹20,000–₹40,000 per sq. yard

- Rental Yield: 2%–3%

With Rajiv Gandhi International Airport, Pharma City, and logistics hubs in the vicinity, Shamshabad is becoming a strategic investment destination. The region is poised for industrial, residential, and commercial growth as Hyderabad expands southward.

Why Invest?

- Close to key employment and transit hubs.

- Ideal for warehouse, logistics, and affordable housing projects.

- Long-term appreciation driven by large-scale government projects.

Ideal for: Industrial investors and those looking for affordable residential plots near major infrastructure developments.

Rental Yield vs. Land Appreciation – What to Expect

- High rental yield (4%–6%): Gachibowli, Financial District, Kokapet (driven by IT employees and expats).

- Moderate yield, strong appreciation (3%–5%): Uppal, Narsingi, Miyapur, Kondapur, Kompally.

- Low yield, prestige-driven appreciation (2%–3%): Banjara Hills, Jubilee Hills.

- Speculative high ROI in future: Adibatla, Shadnagar, Shamshabad.

Key Investment Tips for 2025

- Check upcoming infrastructure projects like metro expansions, ORR interchanges, and SEZs.

- Verify HMDA/RERA approvals to avoid legal complications.

- Diversify your portfolio – mix high-rental zones with long-term growth corridors.

- Monitor registration value hikes – Telangana government is revising core urban land values by up to 30%–50%, impacting purchase cost.

- Focus on reputed builders or clear-title plots to ensure liquidity and resale value.

Final Thoughts

- Looking for high rental income? Choose Gachibowli, Financial District, Kokapet, or Uppal.

- Seeking luxury & prestige? Opt for Banjara Hills or Jubilee Hills.

- Want affordable plots with long-term potential? Invest in Adibatla, Shadnagar, or Shamshabad.

- Balanced investments? Consider Miyapur, Bachupally, Kondapur, or Kompally for both rental and capital growth.

Hyderabad’s real estate market is set to outperform in 2025 and beyond thanks to its IT dominance, proactive government planning, and steady end-user demand. Picking the right area based on your budget, investment horizon, and risk appetite is the key to maximizing your returns.