With the implementation of the goods and service tax in 2017, the real-estate sector will also have to bear the tax from the sale and rents. Previously tax is collected in the name of VAT and service tax. But to bring transparency and accountability, the central government has brought real estate under GST. There will be variations between Commercial properties and residential properties in the collection of GST.

Commercial properties and residential properties are categorized under different categories and levied GST

Let’s look at the commercial property GST

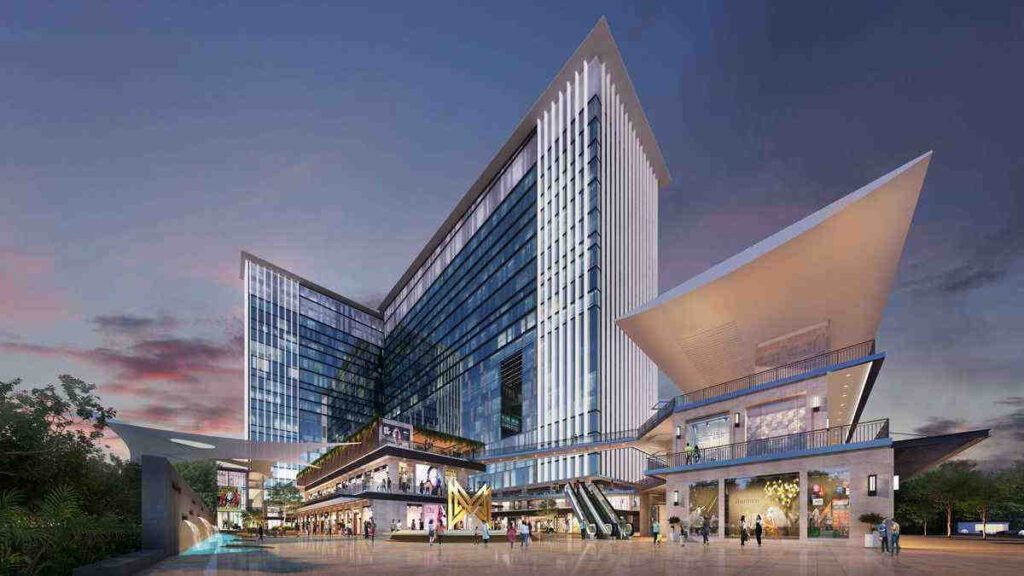

GST on Commercial property

Commercial property GST is taxed at 12% of the total value. Actually, commercial properties are taxed 18%, but from the total property 1/3 of the value is taken as land value. The land is neither considered a service nor good. So, 2/3 value of the Total property is taxed for the commercial property. i.e 12%

GST on Residential property

Residential housing is again categorized in two ways. 1) Affordable housing 2) Non- Affordable housing

1) Affordable housing –

If the property is located in the metropolitan city and if the property costs up to 45 lakhs with measures up to 60 sq meters, then it is considered affordable housing.

GST for Affordable housing is – 1% without the Input tax credit

2) Non- Affordable housing

If the property is located in a non-metropolitan city and if the property costs up to 45 lakhs with measures 90 sq meters, then is considered non-affordable housing.

GST for Non-Affordable housing is – 5% without the Input tax credit